Assessment / Tax Claim Office

Providing Beaver County taxpayers avenues to search real estate assessment and delinquent tax records.

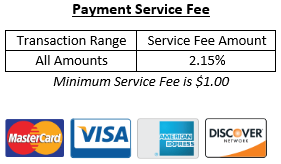

You can now pay your Delinquent Property Taxes online

Payment for requested Assessment reports can now be made by credit card over the phone. Please contact the Assessment Office for additional information.

Assessment / Tax Claim

Upcoming tax Sale

Contact Information

Joshua Eckelberger, Chief County Assessor

Beaver County Courthouse

Assessment / Tax Claim Office

810 Third Street

Beaver, PA 15009

724-770-4480

Office Hours:

Monday - Friday

8:30 am - 4:30 pm (Except Holidays)